What is Risk Analytics?

Risk analytics are used to assess and project potential levels of risk based on existing data. Risk analysis is the process used to determine risk so adverse consequences can be avoided or mitigated.

Why is Risk Analytics Important?

Risk analytics provide the foresight needed to manage risks proactively. Most business operations carry some level of risk. Being too risk-averse can lead to lost opportunities. This analysis process increases the confidence of success when making business decisions by keeping risk at acceptable levels.

Examples of Risk Analytics

Insurance

The insurance industry sets premiums that reflect what risk analytics tell them about the policyholder based on their history, where they live and other factors. Actuaries assess risk across an employee base when providing health insurance for an employer.

Sales Management

All the way up to the Chief Revenue Officer, sales managers need to know how confident they should be about forecasted deals. Risk factors can be assigned to deal-based questions, such as how well-qualified the deal is. Is there a budget? Have the stakeholders been identified and educated? What are the potential barriers? And more. All these variables are used to assess overall risk so appropriate adjustments can be made before communicating the numbers. Regulations such as Sarbanes-Oxley (SOX) compel executives to be aware of the source of revenue and operational expenses.

Investing

When buying shares in a business, risk analytics are used to assess a business’s potential upside revenue potential against the risk of collapsing. Many factors must be considered, including the Price-to-Earnings (PE) ratio should be in line with its industry peers, debt levels need to be acceptable, and operating margins should not be too slim.

Mergers and Acquisitions

Risk analytics can inform decisions on whether a merger or acquisition makes sense. Combined operational costs and revenues can be compared, sentiment analysis can guide the impact on branding, and potential churn can be better calculated.

Autonomous Driving

Self-driving vehicles use data gathered from sensors, including cameras, lidar and navigation systems feeding a neural net to monitor the environment and calculate risks before commencing an action, such as accelerating, taking a turn, or stopping at a crossing.

Entering New Markets

Risk analytics can help by calculating the risks associated with each initiative to arrive at the most balanced outcome when deciding whether to expand a business into a new geography or adjacent industry segment.

Financial Lending

Lenders need to look beyond credit scores when making high-value loans. Analytics such as the appraised value of a home, its condition, the customer’s job history and other factors must be considered before assigning a risk metric to the transaction. During recessions, lenders must offload bad loans to protect their viability.

Benefits of Using Risk Analytics

Risk analytics give organizations the insights they need to justify moving forward on initiatives as small as lending to an individual to something as big as proceeding with a merger. Risk analytics is a core contributor to a due diligence process. Champions of an initiative need to justify a business case and show they have adequately researched the benefits and risks. This is especially important when the initiative fails and a scapegoat is sought. Real confidence comes after risk assessments are completed.

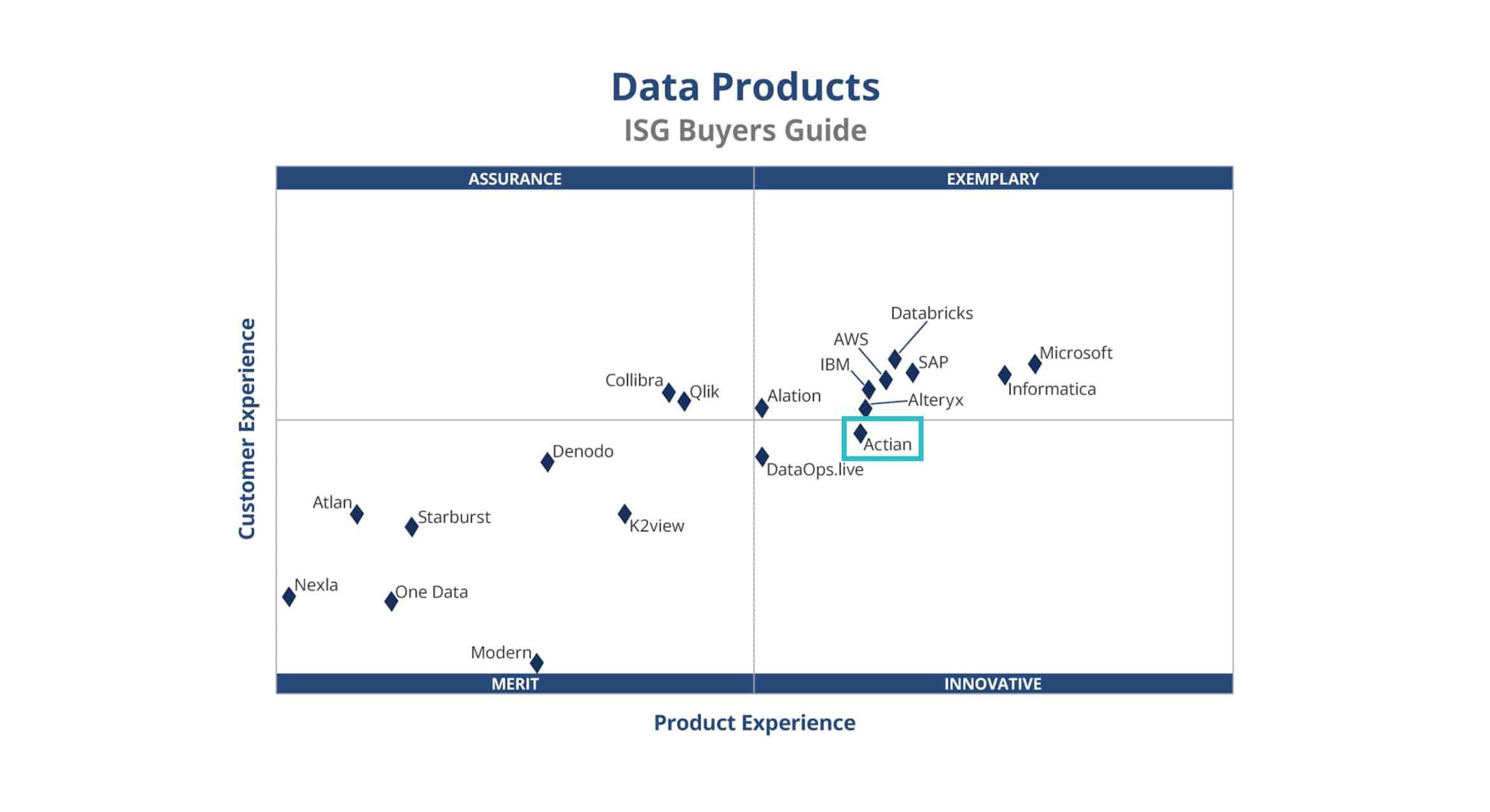

Actian and Risk Analytics

The Actian Data Platform provides a highly scalable data analytics platform with a rich feature set for ingesting, organizing, analyzing, and publishing data. The built-in data integration capabilities make gathering data as streams and batches easy. Data transformation functions help ensure data quality. The Actian Data Platform works with standard SQL for application integration and connecting to all Business Intelligence (BI) tools.